Gold Bars vs Gold Coins: What’s Better for Canadians?

```html

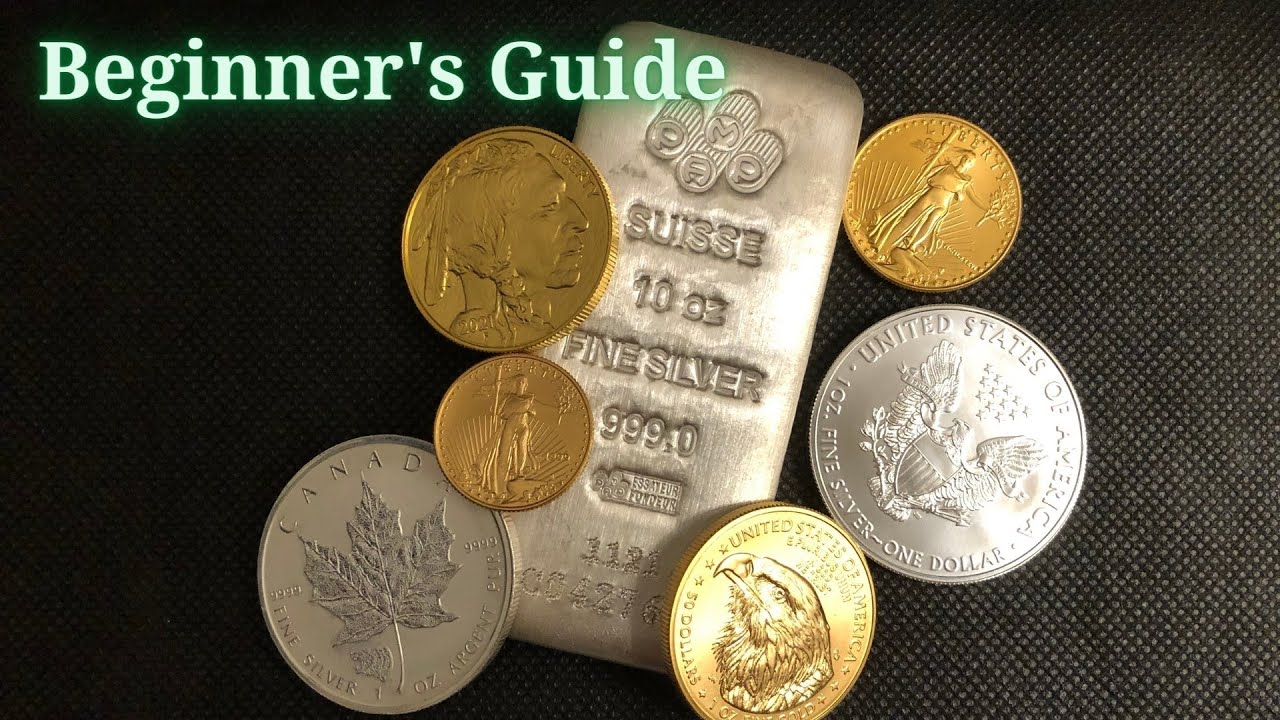

Look, if you’re thinking about diving into the world of precious metals, you’re not alone. The past decade has seen a surge in Canadians looking to protect their wealth from inflation and economic uncertainty by investing in gold and silver. But here’s the kicker: many get so intimidated by the technical jargon and the countless options that they never take the plunge. That’s a costly mistake.

In this piece, I’m going to cut through the noise and give you a clear-headed comparison of gold bars vs gold coins—two of the most popular ways to hold physical gold in Canada. We’ll look at the key differences, the cost nuances like premiums on bars vs coins, and the trust factors involved when choosing where to buy. I’ll even explain why companies like Gold Silver Mart are becoming go-to resources for Canadians aiming to get started confidently.

Entrepreneurship During a Crisis: A Silver (and Gold) Lining

Ever wonder why during economic upheavals, some small businesses thrive? It’s because crises often spark innovation and entrepreneurship—especially in sectors tied www.theyeshivaworld.com directly to financial security. Precious metals dealers like Gold Silver Mart are a prime example. Founded to demystify metals investment for everyday Canadians, they’ve grown rapidly by making metals accessible and trustworthy.

That’s crucial. When markets get volatile, people seek safe havens. Precious metals, historically, have been a reliable inflation hedge. But raw access isn’t enough; trust matters. In a market often plagued by vague fees and dubious dealers, companies that are transparent about pricing and provide straightforward education stand out.

Gold and Silver as an Inflation Hedge: Why Does It Matter?

Sounds crazy, right? In an era where digital currencies and flashy investment apps dominate headlines, a cold, hard metal remains one of the safest stores of value. The reason is simple: gold and silver have intrinsic value tied to their limited supply and global demand.

So, what does that actually mean for Canadians concerned about inflation? When fiat currencies lose purchasing power, gold and silver often retain or increase theirs. This means that rather than watching your dollars erode, your metal holdings could anchor and potentially grow your wealth.

Gold Bars vs Gold Coins: Breaking Down the Investment Comparison

Alright, let’s get to the meat of the matter. When you’re buying physical gold, you usually choose between bars and coins. On the surface, both are shiny, valuable, and a hedge against economic turmoil. But they come with distinct pros and cons.

Gold Bars

- Size and Weight Variety: Gold bars come in a wide range of weights — from as small as 1 gram up to 400 ounces. This flexibility can suit all kinds of investment budgets.

- Premiums on Bars vs Coins: Generally, bars have lower premiums. That means the markup over the gold spot price tends to be less. Buying a 100-gram gold bar often costs you less per gram than an equivalent amount in coins.

- Liquidity Considerations: While bars are widely recognized, very large bars (like 400 oz bars) might be less liquid for average Canadians. They’re heavy and can require more careful handling when selling.

- Storage and Handling: Bars are often packaged in sealed containers, which can make them easier to verify visually but may not be as easily split or subdivided.

Gold Coins

- Recognition: Coins issued by trusted mints like the Royal Canadian Mint enjoy global recognition, making them highly liquid.

- Flexibility: Because coins usually come in smaller weights (1 oz, ½ oz, ¼ oz), they offer more flexibility to sell portions without breaking a larger bar.

- Premiums on Bars vs Coins: Coins usually carry higher premiums due to minting, design, and collectibility factors. That means you pay more per gram compared to bars.

- Collectibility and Appeal: Some coins, like the iconic Canadian Maple Leaf, also hold numismatic value. Though this can be a double-edged sword—collectible coins may be harder to value precisely.

Premiums on Bars vs Coins: Why Do Prices Differ?

Ever wonder why a one-ounce gold coin like the Canadian Gold Maple Leaf often costs more than a one-ounce gold bar? It boils down to supply chain, production costs, and market demand:

- Production Costs: Coins require intricate designs, official stamping, and security features. Bars are more utilitarian.

- Packaging and Branding: Coins receive premium branding (think Royal Canadian Mint quality), which adds to cost.

- Market Demand: Some buyers prefer coins for their storability and recognized authenticity, which can drive prices up.

- Dealer Markup: Dealers factor in handling and resale ease. That markup appears directly in the premium.

For Canadians aiming for cost-efficiency, bars often provide more pure gold per dollar spent. But that’s not the full story.

Liquidity: What Happens When You Need to Sell?

Liquidity, or how easily and quickly you can sell your gold at a fair price, is key. This is where coins often have a leg up. Thanks to their global recognition and guaranteed purity, coins are accepted quickly by dealers and even many investors worldwide.

Bigger bars can still be liquid but might require more careful vetting when selling due to their size and the possibility of counterfeit risks. Additionally, selling a large bar in smaller increments is tough—you either sell it whole or not at all.

For an investor who wants to keep their options open, coins provide flexibility. It’s why companies like Gold Silver Mart carry a well-balanced inventory of both coins and bars, catering to different investor needs.

The Importance of Trust in Financial Services: Why Transparency Matters

Investing in precious metals isn’t like buying a stock on your phone app. You’re handling physical assets that need secure storage, accurate certification, and transparent pricing. Yet many dealers are murky about their premiums and hidden fees. That’s where Canadians get burned or simply walk away confused.

Reliable companies, like Gold Silver Mart, put transparency front and center—clearly showing premiums on bars vs coins, explaining shipping and storage recommendations, and offering educational resources to demystify metals investment for beginners. This no-nonsense approach builds trust in a market that needs it.

Demystifying Precious Metals for Beginners

If you’re new to metals, the most common mistake is feeling too intimidated to start. You might think you need to understand every nuance before making a move, or that only wealthy investors can take part. The truth? Anyone can. And starting small with clear guidance is often the smartest path.

- Start by understanding spot price movements—this is the daily market price for an ounce of gold.

- Know the difference between spot price and premium — that’s what you pay extra for coins or bars over the spot price.

- Consult with trusted dealers who disclose fees openly and don’t pressure you into ‘get rich quick’ schemes.

- Consider secure storage options and insured shipping. Even the best gold isn’t worth much if lost or stolen.

Like my silver Maple Leaf coin paperweight reminds me every day—real wealth is tangible, not just digital numbers flashing on a screen.

Summary Table: Gold Bars vs Gold Coins for Canadians

Feature Gold Bars Gold Coins Typical Weights 1 gram to 400 oz Various, mostly 1 oz and smaller denominations Premiums Over Spot Lower Higher (due to minting & collectible appeal) Liquidity Good but larger bars less flexible Excellent, widely recognized (e.g., Royal Canadian Mint) Storage Sealed bars, easier bulk storage Individual coins, easy to divide holdings Trust & Verification Depends on manufacturer & assay High (especially RCM coins)

Final Thoughts: What Should Canadians Choose?

So, what’s better — gold bars or gold coins? The answer depends entirely on your goals.

- If you want to maximize gold content per dollar and invest larger sums, bars are generally more cost-effective.

- If you prefer flexibility in selling, trusted global recognition, and smaller denominations, coins from reputable sources like the Royal Canadian Mint are the way to go.

- Above all, front-run the intimidation and start. Transparency and education are your best allies, which is why trusted dealers like Gold Silver Mart are such valuable partners for Canadians entering precious metals investing.

Remember: In a world chasing quick digital profits, holding a tangible asset like physical gold is both a nod to tradition and a smart hedge for your financial future. Trust in your sources, educate yourself, and take the first step with confidence.

```